Global programmatic media partner, MiQ released its Festive Shopper Insights 2025 Report, offering an in-depth look at the evolving behaviour of India’s festive shoppers and the strategies brands must adopt to win this season.

The study, based on insights from over 4,800 festive shopping enthusiasts across India, reveals four key trends shaping consumer behaviour – the rise of the Rs. 20,000+ confident spender, a surge in brand discovery, an early start to advertising spends and regionally distinct festive aspirations.

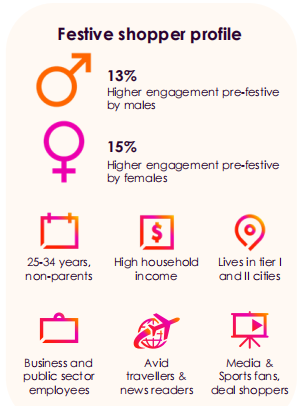

The core festive shoppers are confident, high-income 25-to-34 year olds from Tier I and II cities. This consumer group has strong discretionary spending power due to higher disposable incomes and is highly responsive to festive offers and deals making them the prime audience for brands to engage with during the season. They begin their purchase journey weeks in advance, making early, multi-channel campaigns critical for brands to stay relevant.

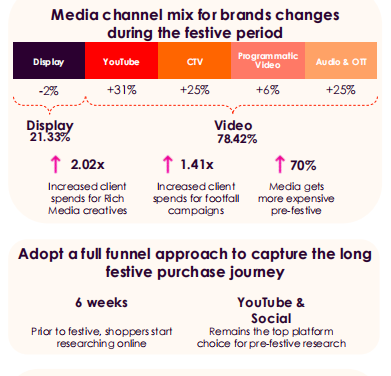

The high consumer tech-literacy among this group of shoppers also results in strong digital adoption, indicating brands to take a digital-first approach as YouTube and social platforms lead discovery and deal hunting. Shopping research starts nearly six weeks before Diwali, with YouTube and social platforms dominating discovery. Advertisers are responding with heavier investments in video, Connected TV (CTV), and OTT while display loses ground.

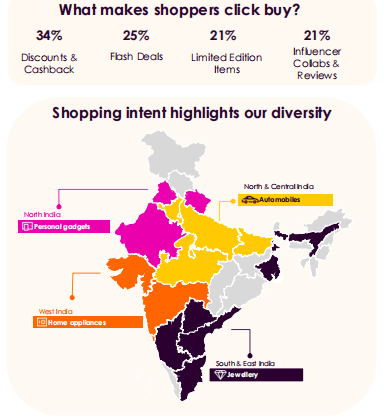

The report also finds that India’s festive shoppers are motivated by a mix of value and aspiration, with 34% prioritising discounts and cashback, and a quarter influenced by flash deals, exclusives, and influencer recommendations. Gender behaviours also differ, males dominate the pre-festive research phase, while female shoppers increase engagement closer to Diwali.

Festive Trends to Watch in 2025:

- The Rise of India’s Rs. 20,000+ Shoppers

· 43% of consumers plan purchases above Rs. 20,000, reflecting a wave of confidence-driven spending.

· Drivers include deep discounts, limited-edition launches, cashback incentives, and influencer-fuelled FOMO.

- Brand Discovery Boom – The Year of the Challenger

· 45% of festive shoppers are open to trying new brands, giving both emerging D2C challengers and established giants equal opportunity.

· Tools like digital sampling, influencer reviews, Augmented Reality (AR) try-ons, and viral campaigns are shaping choices like never before.

- The Media Gold Rush Diwali’s Early-Bird Advantage

· Advertisers are launching campaigns 30+ days ahead of Diwali, sparking an early scramble for consumer attention.

· Programmatic video, shoppable social, and rich media creatives dominate spends, even as CPMs continue to climb.

- Regional Pulse Driving Diverse Festive Aspirations

· North & Central India: High intent for automobiles, gadgets, and appliances.

· South & East India: Rural demand for two-wheelers and tractors, alongside jewellery despite rising gold prices.

· Urban India: Softer early 2025 categories, though gold remains an investment-driven festive favourite.

Speaking on the findings, Varun Mohan, Chief Commercial Officer India, MiQ says, “This festive season is no longer just about shopping, it is about cultural moments amplified by media. Our data indicates a new kind of Indian shopper who is confident, experimental and digitally led. For brands, the mandate is clear – launch earlier, speak authentically across regions, and embrace a full-funnel approach. At MiQ, we’re enabling advertisers to unlock these high-value festive moments with technology, data and creativity that deliver impact where it matters most.”

The stakes in 2025 are higher than ever. While shoppers are ready to splurge, brands face fiercer competition for attention. With festive CPMs inflating, marketers must lean on smarter omnichannel planning to optimize impact. The report also notes that brand discovery is democratized, offering challenger brands a real shot at winning share through influencer partnerships, engaging storytelling, and immersive activations.