For years, scale in Indian food meant adding more cities, more menus, more kitchens. Now, the fastest growth happens quietly between the bites: a 2 AM cake ordered via Zomato’s peer-turned competitor set, a post-gym smoothie via Blinkit, or a regional favourite in emerging cities like Indore, Madhya Pradesh, India gaining more traction than legacy dinner slots. Whether you run a café corner in a shopping centre or a fast-growing cloud-kitchen cluster, the story is clear: India’s food economy is expanding by occasion, not just consumption.

A USD 125 Billion Food Services Market by 2030 — But the Shape of Growth Matters

- According to the 2025 edition of “How India Eats,” the 2nd annual study Swiggy, this year in collaboration with Kearney India, Indian food services market (dine-in + delivery + cloud kitchens + QSR etc.) is forecast to cross US$ 125 billion by 2030.

- In 2025, the market is estimated at about US$ 78 billion, up from ~US$ 49 billion in 2019.

- Importantly: the organized segment (platforms, branded QSRs, cloud kitchens) is growing at twice the pace of the unorganized sector, and is expected to overtake the unorganized segment before 2030.

- That implies more than just volume growth: a structural shift in how Indians consume food — and a huge opportunity for institutional players (restaurants, real-estate owners of food real estate, food-tech, retail, supply chain).

Thus, we’re not just seeing a bigger food-services pie, but a different one: more organized players, brands, and consumption occasions.

From Biryani to Boba: Culinary Curiosity, Rediscovery and Duality

One of the most striking findings: food preferences are diversifying in opposing yet complementary ways — global curiosity and regional rediscovery are rising in tandem.

- According to “How India Eats,” there’s been a 20% increase in the number of unique cuisines ordered per customer, and a 30% increase in the number of restaurants ordered from per customer.

- On the “global cuisine” front: Korean food demand has grown 17×, Vietnamese 6×, Mexican ~3.7–4× (various reports cite ~4×).

- On the “heritage / hyper-regional” side: cuisines such as Goan, Bihari, Pahari — long underrepresented — are now growing 2–8× faster than “mainstream” cuisines.

- Drink preferences reflect this duality too: local beverages like buttermilk, sharbat, traditional drinks are seeing growth at 4–6× compared with overall beverage category; meanwhile, global-style beverages like Matcha and Boba tea have seen search interest surge by 4× and 11× over the past few years respectively.

- On top of that, “indulgence” and “health-conscious eating” are growing simultaneously — not substituting each other. For instance: healthy / “better-for-you” meals are reportedly growing at 2.3× the rate of overall orders.

Implication: The modern Indian consumer is embracing a hybrid palate — craving both comfort & nostalgia (local/regional) and novelty/global (international cuisines). For restaurants/QSRs/food-tech, it means portfolios need to balance — maybe a regional-heritage menu alongside global fare, or curated offerings for “health” and “treat” segments.

The “New Occasion” Framework: Late-Night, Mid-Week, Tier-2/3 & Beyond Metros

The report — and some corroborating data — point to a fundamental shift in when, where and how India eats out / orders in.

- Late-night meals are reportedly growing at a rate of roughly 3× that of dinner.

- The fastest-growing late-night categories: pizzas, cakes, soft drinks — suggesting snacking / indulgence post-midnight is becoming mainstream.

- At the same time, “healthy / better-for-you” meals are rising fast (as above).

- Beyond metros: demand growth in Tier-2 and Tier-3 cities (and beyond Top-8) is now twice that of the top 8 cities (metros).

- Demographic drivers: younger consumers (Gen Z), who are more experimental, social-media–savvy, and open to global cuisines and “Instagram-worthy” experiences — are reportedly growing 3× faster than other age cohorts in the dining-out segment.

Implication: Food businesses — QSRs, cloud kitchens, ghost kitchens, even quick-commerce / convenience delivery — cannot focus just on metro dinner/ lunch demand. The “occasion stack” has expanded: late-night, mid-week, value meals, healthier options, regional & global fare — in smaller cities too.

For investors and landlords: food real estate value may shift — spaces that cater to late-night, snack/ dessert, quick-service, and tier-2/3 demand could see disproportionate growth compared with traditional full-service dine-in only outlets.

Quick Commerce + Cloud Kitchens: The Acceleration Engine

The shift is not just in what people eat — but how they order and when. The report points to a rising role for quick-commerce and instant-fulfilment.

- The quick-commerce arm of Swiggy — Swiggy Bolt — now apparently contributes over 10% of all orders on the platform.

- For many brands on Bolt, quick-commerce is already “dominant,” especially in demand-dense categories like snacks, desserts, beverages — and even late-night consumption.

- This suggests a continuing shift from dine-in and classical food delivery toward “instant, on-demand” food and beverage consumption — anytime, anywhere.

Implication: Cloud kitchens, dark kitchens, QSRs optimized for quick consumption & delivery — especially in snack, dessert, beverage, light meal categories — stand to benefit disproportionately. For real estate (mall food courts, high-street quick-service corners), there may be renewed value in small footprint, high-turnover formats.

The New Competitive Arena: Value, Premiumisation & Packaging Innovation

Another dimension the report highlights: a tension (or balance) between value-led consumption (especially in “familiar” cuisines) and premiumisation/ experimentation.

- For traditional/familiar cuisines (Indian, Italian, etc.), there’s “tilt toward lower price bands” — signalling that consumers are being value-conscious even as dining out becomes more frequent.

- On the other hand, there’s “steady premiumisation” in cuisines such as Mughlai, American, South-Indian gourmet, and in global cuisines — meaning there is rising demand for tastier, curated, experience-led food.

- Packaging and delivery-experience are becoming a differentiator: examples include “butterfly burger boxes that unfold into plates,” or “slow-cooked biryani delivered in earthen handis” — reflecting that delivery packaging is increasingly being designed as part of the “dining experience.”

Implication: Players who combine value with experience — e.g., affordable comfort food with aspirational packaging/brand narrative — will have an edge. Also opens opportunities for cloud kitchens and QSRs to differentiate not just on menu, but on delivery-experience and convenience.

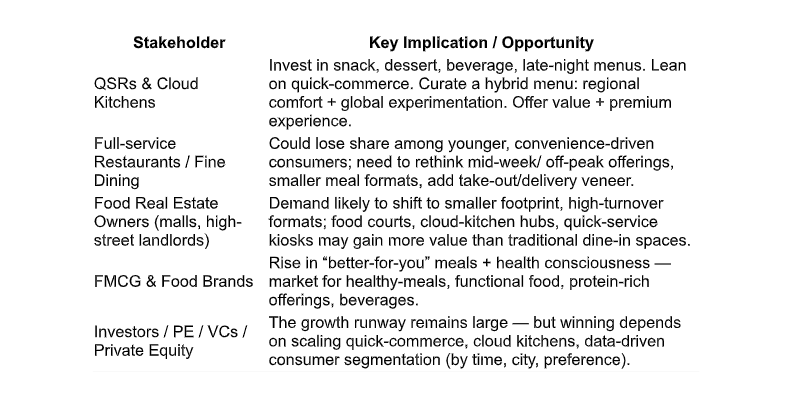

What This Means for Key Stakeholders

Here’s a quick breakdown of what these trends mean — and what the winning playbook might look like — for different stakeholder groups:

Why This Report Matters — And What to Watch Out For

- The forecast to US$ 125B by 2030 signals that India’s food-services market still has deep structural headroom — especially compared to peer economies (organized segment’s share of GDP is currently low: ~1.9% vs 5–6% in Brazil/China).

- The simultaneous rise of “comfort/regional” + “global/experimentational” eating suggests that Indian food culture is becoming more heterogenous — opening space for niche, differentiated food concepts rather than just mainstream or premium.

- Food consumption is evolving into a 24×7, multi-occasion phenomenon — not limited to main meals, dine-in occasions or weekends. That materially expands the value of convenience, speed, and affordability.

- The growth of quick commerce and delivery-led consumption — especially in “snacking / beverage / late-night” — could reframe the competitive battlefield.

But there are also challenges, or at least questions to examine:

- Will supply-side (kitchens, delivery partners, quality, packaging) be able to scale at the same pace as demand — without compromising margins or service?

- As smaller cities drive the next wave, will infrastructure (logistics, delivery density, kitchen quality, supply chain) be robust enough for consistent consumer experience?

- As competition intensifies (cloud kitchens, QSRs, FMCG meal-kits, restaurants), will brand differentiation and consumer loyalty become harder — meaning only those with tight cost control, execution, and brand identity will win?

What’s Next — The Strategic Playbook for 2026–2030

Based on the data and directional shifts, here’s what food-sector players should ideally be doing now:

- Build “menu portfolios” not just restaurants — hybrid menus combining regional comfort, global curiosity, health-forward & indulgent options; dynamically switching per city / consumer segment.

- Lean into quick-commerce, small formats and cloud-kitchen models — especially for late-night, snacking, beverage, dessert, convenience meals.

- Use data (city, time, consumption patterns) to segment & localise offerings — Tier-2/3 vs metros, young vs older, weekday vs weekend, lunch vs late-night.

- Invest in packaging & “delivery as experience” — delivery must go beyond just food-on-box; premiumisation & unboxing experiences will matter.

- Tap health / wellness demand — high-protein meals, better-for-you options, dietary conscious offerings can ride the rising preference for nutrition and wellness.

- Rethink real estate strategy — smaller footprint, high-turnover formats may outperform sprawling dine-in outlets. Mall owners and landlords need to re-evaluate yield per sq ft vs occupancy cost.

- Position for scale — but don’t lose nimbleness — in a fast-evolving market, agility, menu relevance, and cost-efficient supply chain will be as important as scale.

A Market in Flux — But the Direction Is Clear

The 2025 edition of “How India Eats” captures a moment of transformation for Indian food culture and commerce. The old dichotomies — dine-in vs delivery, metro vs small-city, regional vs global, indulgence vs health — are collapsing. A new food-economy is emerging: fluid, hybrid, convenience-driven, data-educated and expansive.

For those who read the signals right — be they cloud-kitchen entrepreneurs, QSR chains, FMCG brands, real-estate owners or investors — the next five years offer a once-in-a-generation opportunity. But success will depend on understanding the nuance: catering to multiple occasions, consumer moods, price-points, geographies and formats — not just replicating legacy models.