Indian Railways — a system that moves 3.5 crore passengers every day — has finally opened its concourses to major national and global QSR brands. With the Railway Board’s approval of premium, single-brand food outlets, chains like McDonald’s, KFC, Pizza Hut, Subway, and Haldiram’s are preparing to enter an environment unmatched in scale, density and consumption potential.

For decades, stations remained a captive market trapped in outdated catering structures. This new decision marks a decisive shift from a low-investment “chai–poori” stall model to a structured, audit-driven, QSR-ready retail ecosystem comparable to airports and global rail hubs.

Why This Decision Took So Long — The Real Factors Behind the Delay

1. A catering mindset — not a retail vision

Food at stations was treated as a compliance necessity, not a revenue engine. Legacy contractors operated on low CapEx and low hygiene standards, keeping organised players away.

2. Infrastructure wasn’t QSR-ready

Stations lacked essential back-end systems:

- power and exhaust capacity

- grease traps and drainage

- waste management

- clean back-of-house zones

- fire-safety compliant kitchen spaces

QSR-grade formats cannot scale without QSR-grade infrastructure.

3. The policy architecture needed modernisation

Railways functioned under zone-wise catering rules, unlike airports (concession model) or malls (retail leasing). A unified, retail-first policy came only with the November 2025 Railway Board circular.

4. Redevelopment had to come before retail

The last six years saw the rise of modernised stations like:

Rani Kamlapati (Bhopal), Gandhinagar Capital, Ahmedabad, New Bhubaneswar, and SMVT Bengaluru.

These upgrades demonstrated what world-class concourses and commercial zones could look like — creating the foundation for branded QSRs.

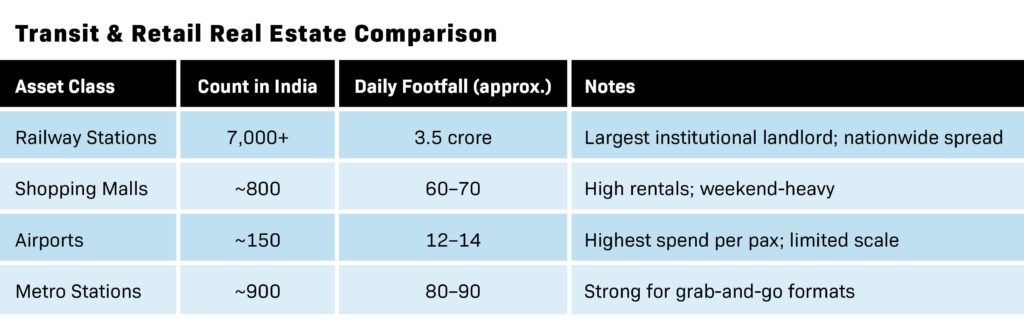

India’s Largest Untapped F&B Real Estate — Now Unlocked

The Indian Railways network is the single largest retail real estate portfolio in the country. The comparison below shows why the opportunity is unprecedented.

Railway stations → Largest network + highest daily footfall + widest geographic reach.

No other real-estate asset in India offers this level of throughput, consistency and natural demand.

Globally, travel hubs generate the highest F&B revenue per sq. ft. Indian Railways is finally aligning with this model.

The QSR Advantage: High Volume, Low CAC, All-Day Demand

Railway stations create a uniquely favourable business environment for QSRs:

- Near-zero CAC — passengers arrive organically

- Crores of daily footfalls

- High impulse-driven consumption

- Long dwell times during delays

- Family/group travel behaviour amplifies ticket size

- 24×7 operational potential

Even a 0.5% conversion at a major station can outperform many high-street locations.

Who Is Driving This Transformation?

The shift is being enabled jointly by:

- Railway Board — policy & category approval

- Commercial Department, Zonal Railways — site allotment, licensing

- IRCTC — e-auctions, food plazas, operational audits

This is the first time all three arms are aligned under a retail-centred approach, not a catering contract structure.

How Brands Can Enter Railway Stations — The New Process

QSR Application Pathway

- Track IRCTC/Zonal e-auctions for “Premium Brand Outlets”.

- Register as a vendor — PAN, GST, FSSAI, DSC, financials.

- Submit technical + commercial bid on e-procurement portals.

- Secure a 5-year licence with renewal based on performance.

- Execute fit-out per railway guidelines.

- Operate under continuous hygiene & service audits.

This marks the beginning of a formal, scalable, modern retail ecosystem inside stations.

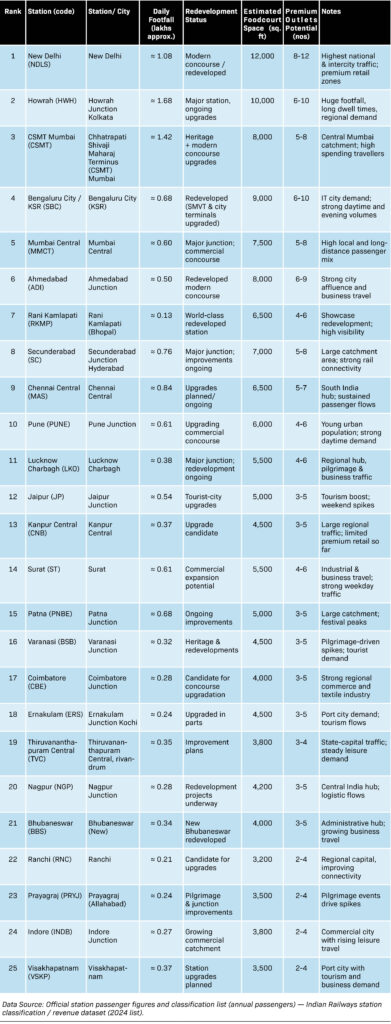

High-Potential Stations for QSR Expansion

A mix of footfall, redevelopment status, traveller profile, and city-level consumption makes the following stations particularly strong candidates for branded F&B:

Data Source: Official station passenger figures and classification list (annual passengers) — Indian Railways station classification / revenue dataset (2024 list).

How Big Can This Market Become?

If even:

- the top 200 stations adopt premium-format F&B

- with 3–5 outlets per station

India instantly creates a pipeline of 600–1,000 new QSR outlets — equivalent to the full footprint of several established chains.

With hundreds of stations under redevelopment, the long-term potential is significantly larger.

Why This Marks a New Era for India’s F&B Industry

This development represents far more than the arrival of global QSR logos on railway concourses. It signals:

- the formalisation of India’s largest unorganised food market

- a decisive uplift in hygiene, safety and service standards

- the shift from legacy catering to airport-style concession economics

- the emergence of transit retail as a high-volume, mainstream F&B channel

- a fully open runway for national, regional and global brands to scale

Railway concourses are no longer functioning merely as transit corridors — they are evolving into India’s next major consumption arenas.

Indian Railways hasn’t just approved branded food outlets; it has unlocked the country’s largest, densest and most commercially powerful F&B real-estate ecosystem.

This marks the start of India’s third — and undoubtedly the largest — travel-retail wave.

The journey from “chai–poori on the platform” to modern, global-standard QSRs in the concourse has truly begun.