Navigating the competitive landscape of Fast-Moving Consumer Goods (FMCG), especially in packaged foods, presents a constant challenge: Reaching consumers effectively with new products. With companies rapidly launching innovations to capture market share, securing shelf space in Traditional Retail and affording placements in Modern Trade has become increasingly difficult and costly.

To address these challenges, FMCG and packaged food companies are increasingly turning to their own brand stores or outlets. These stores, whether company-owned or franchised, serve dual purposes: enhancing brand equity by creating immersive brand experiences and fostering deep consumer loyalty, particularly for products with frequent purchase cycles.

Reaching consumers with the right products is one of the foremost challenges that every organization in the Fast-Moving Consumer Goods (FMCG) sector, especially in packaged foods, faces day in and day out. With consumer-packaged food companies rolling out new products at an enormous pace to gain consumer acceptance and market share, shelf space in Traditional Retail has become a limiting factor while in Modern Trade, it has become increasingly expensive to place new products on the retail shelves.

Many times, the new products launched by packaged food companies become slow-moving products due to lack of shelf visibility and opportunities for trial purchase. Trial purchases often result from the pull created by high investments in advertising and promotions. Today, consumers are increasingly interested in experiential shopping and product variety. It is now critical for manufacturers to innovate in line with the changing purchasing habits of their customers.

To overcome many of these difficulties, FMCG and packaged food companies have been venturing into setting up their own brand stores or outlets. These own brand stores are either company-owned and operated or franchise-owned and operated. Usually, own brand retail stores follow one of these two models:

- Own Brand Retail Outlets with product and brand experience, called the Parlour/ Experience Model

- Own Brand Retail Outlets with distribution of the products in the outlet catchment areas, called the Distribution Model. The product and brand experience are maintained within the store, where the owner also handles distribution within the designated area.

The Operational Model will be a mix of the following:

1.Company Owned and Company Operated (COCO)

2.Company Owned and Franchisee Operated (COFO)

3.Franchisee Owned and Franchisee Operated (FOFO)

4.Franchisee Owned and Company Operated (FOCO)

The advantages of the Franchised Own Brand Retail Parlour/ Distribution Centres are:

- For companies with a wide range of products and SKUs, establishing franchised own brand retail parlours or distribution centres can significantly enhance distribution and availability across all their offerings. This contrasts with the traditional FMCG distribution model, where only fast-moving products or SKUs receive widespread distribution, leaving slower-moving or new products to struggle due to limited shelf space in both traditional and modern retail settings.

2. The Franchised Own Brand Retail Parlour/ Distribution Centres are ideally suitable for:

- Short shelf-life products which require cold chain transportation and storage and cannot be distributed in large territories/ areas.

- Retail replenishment is very frequent and almost daily and hence most suitable for Milk, Dairy and Non-Dairy Products.

- The distribution of products is strategically timed, often focusing on early mornings to align with consumer buying patterns and preferences.

- In categories with rapid introductions of new products, variants, or SKUs, success hinges on franchised own brand retail parlours or distribution centres. These outlets play a crucial role in ensuring the visibility and availability necessary for the success of these new offerings.

3. The Franchised Own Brand Retail Parlour/ Distribution Centres create brand and product experiences that serve as effective alternatives to expensive mass media advertising and promotions.

4. The Franchised Own Brand Retail Parlour/ Distribution Centres gives the Brand a premium imagery and also enables the company and the trade to realise better prices and not get into the trap of vicious price discounting.

5. Through the Franchised Own Brand Retail Parlour / Distribution Centres, the brand can create localised Marketing and BTL activities for promoting the brand.

6. The Franchised Own Brand Retail Parlour/ Distribution Centres will enable the companies to introduce local and regional flavour products without diminishing the brand image.

7. Another significant advantage arises when distribution exclusively relies on franchised own brand retail distribution centres: it eliminates the need for additional layers of distributors, resulting in savings of 6-10% on channel costs/ margins. This model incorporates distribution costs and margins within retail operations, streamlining efficiency.

8. The tertiary sales from the Franchised Own Brand Retail Parlour/ Distribution Centres will be well monitored because of which the performance of new and existing products can be immediately known.

Brand Retail Outlets with Parlour/ Experience Model

In Dairy, India’s leading private sector dairy products company, Hatsun Agro Product Ltd (HAPL) has the largest Own Brand Retail Distribution Centres network with over 4,000 outlets present across Tamil Nadu, Andhra Pradesh, Telangana, Puducherry, Kerala, Gujarat, Goa, Maharashtra, Karnataka, Chhattisgarh and Orissa.

HAPL prioritizes customer experience and places strong emphasis on achieving this through their retail stores. Their leading retail brands include HAP Daily, Ibaco, and Arun Ice Cream Parlours. Ibaco stands out as a premium chain of ice-cream outlets where customers can customize their own ice cream sundaes. On the other hand, HAP Daily represents Hatsun Agro Product Ltd’s franchised retail distribution centre concept, offering milk, milk products, and ice creams conveniently to customers. HAP Daily not only serves domestic consumers directly but also distributes all products to retailers in designated areas.

Initially, Hatsun Agro Product Ltd distributed its milk and dairy products through a traditional FMCG model, where distributors delivered Arokya Milk and Hatsun Dairy Products to a network of dealers. However, this approach often left gaps in distribution coverage.

To address this challenge, HAP Daily was introduced as franchised own brand retail distribution centres. Originally launched under the FOFO (Franchise Owned, Franchise Operated) model, the initiative faced significant franchisee dropouts. As a result, it transitioned to the COFO (Company Owned, Franchise Operated) model, which eliminated the layer of distributors.

Today, Hatsun Agro Product Ltd operates exclusively through these franchised own brand retail distribution centres, selling Arokya Milk, Hatsun Dairy Products, and Arun Ice Creams. The company’s turnover has grown to over Rs. 8,000 crore, driven by a network of more than 4,000 HAP Daily centres.

The success of Hatsun Agro Products Ltd. inspired many private dairy companies to launch their own franchised own brand retail parlours or distribution centres. Companies like Heritage Foods, Godrej Jersey, Dodla Dairy, Milky Mist, and others followed suit. However, a significant difference emerged: these companies retained their existing FMCG distribution networks while adding franchised own brand retail parlours or distribution centres. Adopting this dual approach comes with an attendant risk: It could lead to suboptimal performance in the franchised outlets.

Many imitators of Hatsun Agro hastily launched their own franchised own brand retail parlours or distribution centres without adequate planning. In contrast, HAP Daily adheres to a meticulous planning process:

Firstly, it identifies suitable areas within cities or towns for establishing franchised own brand retail distribution centres. Next, it selects franchisees based on predefined criteria and collaborates on mapping the catchment area. The franchisees undergo comprehensive training before setting up stores according to standardized design specifications.

Promotional activities are then strategically implemented to attract planned customers and consumers. Throughout this process, HAP Daily provides continuous guidance and support to franchisees, assisting them in growing their businesses until they achieve breakeven and profitability.

In Spices & Culinary Products, many companies manage a vast array of products and SKUs, posing significant challenges in distributing them to grocery stores or modern trade outlets. For instance, consider a category like pickles from a national brand such as Mother’s Recipe, which offers seventy-two different pickle recipes or products. Each of these products comes in multiple pack sizes, resulting in nearly three hundred SKUs that need to be managed at various levels: from the factory and regional warehouses to state warehouses or CFAs (Carrying and Forwarding Agents)/super stockists, and finally at the distributor levels.

In grocery stores, only the fast-moving variants of popular products typically make it onto retailer shelves. Following pickle categories, there are also whole spices, pure spices, blended spices, ready-to-eat meals, and instant mixes. This variety presents a challenge for consumers seeking specific preferences. For example, a North Indian living in Chennai or Bangalore might struggle to find his favorite North Indian mango pickle or Punjabi mango pickle in local stores. Similarly, South Indians living in Delhi may face difficulty locating Andhra avakaya or tomato pickle.

To address these challenges, companies like Priya Foods in Hyderabad and Mother’s Recipe in Pune have embraced the concept of exclusive or single-brand stores. This strategy allows them to directly connect with consumers by offering their complete range of products. Priya Foods, for instance, has expanded its exclusive own-brand stores throughout Telangana and Andhra Pradesh, reaching Tier I and II towns and establishing a strong presence among consumers in these regions.

In the Poultry, Meat, and Egg industry in India, consumers generally prefer live birds over chilled or frozen meat due to perceptions of better taste and texture. This preference has shaped the market, making the Indian broiler sector predominantly focused on live-bird sales. More than 90% of poultry processing in India is done manually, highlighting the critical need for hygienic slaughtering practices and effective use of by-products.

The market faces challenges such as regional imbalances in production and consumption, hindered inter-regional bird movement due to high mortality rates during transport, and fluctuating broiler prices based on local demand and supply dynamics. Additionally, religious considerations in different regions lead to seasonal drops in meat demand.

Transitioning towards a chilled or frozen product market is crucial for the broiler industry’s evolution. Poultry integrators are driving growth in the retail segment through innovative approaches like establishing their own or franchised chilled/ frozen poultry shops, setting up counters in existing food outlets, and offering home delivery services. The rise of supermarkets and malls further supports the retailing of chilled and frozen poultry products.

Key players like Suguna with “Suguna Daily Fressh”, Baramati Agro’s Chicken Vicken, Venky’s Express, and others are expanding their distribution networks, including creating neighbourhood cold freezer outlets to reach consumers directly. This expansion is driving the demand for cold chain infrastructure, including cold storage facilities in smaller towns.

There is also a growing need for collaboration between major poultry players and white goods/ appliance manufacturers to promote frozen food appliances such as deep freezers and microwave ovens with defrost capabilities. This collaboration could further accelerate the adoption of chilled and frozen poultry products among Indian consumers.

Traditional poultry egg sales occur in live poultry dressing facilities at wholesale or retail levels, which are predominantly manual and lack proper sanitary measures for the dressing floor, workers, and storage areas. This method of handling eggs does not guarantee hygienic conditions throughout the process from slaughtering to delivery.

Indian consumers typically prefer to buy fresh meat and eggs from wet markets or live bird markets. There is a prevailing perception that purchasing poultry products as live birds and witnessing their slaughter ensures better quality. Consequently, ensuring hygienic slaughtering practices and efficient utilization of byproducts remain critical challenges in the Indian meat industry.

In addition to these concerns, the quality of eggs sold in traditional retail stores is a significant issue for consumers. When purchasing eggs from these outlets, consumers often face uncertainties about several factors, including:

- Freshness of the eggs and its shelf life. Due to the low shelf life of these eggs, consumers make frequent purchases and prefer not to store them at home.

- Eggs come with organic dirt, unhygienic shells, and faecal matter.

- Hairline cracks which reveal only on usage resulting in wastage.

- Poor packaging and delivery.

- Eggs have high pesticide and antibiotic residues.

- Small and uneven size eggs resulting in poor value for money.

- Most of these eggs are sourced from unorganised farms wherein the chicken feed given is of poor-quality containing animal wastes and by-products resulting in poor nutritive eggs and eggs with strong bad odours.

The growth of the retail segment for poultry products is being driven by innovative strategies from poultry integrators. These include establishing integrator-owned or franchised chilled/frozen poultry shops, setting up sales counters within existing food stores, and offering home delivery services. The rise of supermarkets and shopping malls has further bolstered the retailing of poultry products, including eggs.

In India, most poultry integrators are now focusing on marketing dressed and chilled poultry products, as well as ready-to-cook and ready-to-eat options, including eggs, to both institutional and retail customers. There is a growing consumer emphasis on quality and hygienic food practices, leading to increased demand for processed meat and eggs.

In this context, OvoFarm, a leading poultry egg farm in the eastern region, has launched Kenko Agstra Retail Stores with the following objectives:

- Ensure the provision of clean, hygienic, and nutritionally enriched eggs for consumers.

- Offer enticing retail buying experiences to enhance customer satisfaction.

- Provide complementary products that contribute to healthy nutrition options for families during breakfast.

- Serve as a knowledge hub where consumers can access additional information on healthy breakfast choices and the benefits of eggs.

- Establish itself as the go-to egg-centric retail outlet in its local areas, catering to both domestic consumers and retailers/resellers. Additionally, offer convenient home delivery services through the Kenko Agstra App.

- Address the challenge of price fluctuations in the poultry egg market, which can impact organised poultry farms when prices fall below production costs.

To ensure price stability and deliver superior products, OvoFarm introduced the concept of “Kenko Agstra,” an exclusive branded store focusing on an egg-centric breakfast destination. The store offers premium, clean, and hygienic packaged eggs that surpass those found in typical retail outlets. Customers benefit from OvoFarm’s commitment to minimal antibiotic use, certified disease-free farming practices, and automated egg grading, ensuring high quality and freshness.

Each egg sold at Kenko Agstra displays its manufacturing date directly on the shell, providing transparent information about freshness. Additionally, customers can utilize a blockchain technology app available in-store to trace the source and age of the eggs they purchase, further enhancing transparency and consumer confidence.

Brand Experience Stores in FMCG

Unlike major FMCG brands like Coca-Cola, which open brand stores primarily to foster brand love among consumers, Indian FMCG companies are leveraging exclusive brand stores to create brand experiences. These stores serve as platforms to showcase the entire range of products that might not be readily accessible to consumers through traditional retail channels.

These exclusive brand stores not only display the full spectrum of products under the brand but also facilitate direct interaction between brand owners and both current and potential consumers. This interaction allows for the promotion of new product offerings while reinforcing the existing brand proposition.

An example of this approach is Happilo, a brand specializing in nuts, dry fruits, seed mixes, and value-added products, which has established its own exclusive brand store in Bangalore. The Happilo Brand Store aims to enhance the brand’s presence by showcasing its diverse product range directly to consumers.

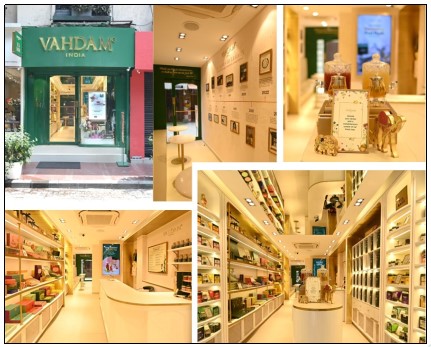

The Vahdam Tea House in Khan Market, New Delhi stands out as a unique experience center in India, celebrating both its products and brand story. Vahdam, known for its direct-to-consumer approach with tea and exotic herbs, has created this iconic space to showcase and market its offerings. Their marketing strategy is refreshingly straightforward: they distribute samples to consumers, believing that the product itself is paramount.

Located between the middle and back lanes of Khan Market, the shop’s narrow frontage features a distinctive green curved element, a signature of the brand. Brass signage and effective branding complement the environment, with a raised platform showcasing beautifully designed gift boxes.

The Vahdam concept tea room is designed to provide an immersive experience that reflects the brand’s vision and engages tea enthusiasts. The store layout is well-organized, with dedicated areas for tea tasting and prominently displayed artisan tea canisters in Vahdam’s signature green, introducing visitors to the diverse world of tea. Light wood shelves with brass accents enhance the elegant display of tea boxes.

Visitors who engage with the Vahdam Tea Experience are likely to become passionate advocates for the brand, both locally and globally. The brand’s allure is elevated by endorsements from high-profile ambassadors like Oprah Winfrey, Ellen DeGeneres, Mariah Carey, and others, further cementing its reputation in the industry.

Future of Franchised Own Brand Retail Stores (Parlour/ Distribution Centres)

Exclusive own brand retail stores serve multiple strategic purposes beyond merely enhancing distribution and availability at the local level. They significantly bolster brand equity among consumers by fostering crucial brand experiences. This heightened engagement often translates into increased brand loyalty, as consumers perceive the brand as their own and develop deep-seated attachments, especially for products with frequent or daily purchase cycles.

In the context of low-involvement FMCG products, these retail stores play a pivotal role in reinforcing brand experiences and generating trials for newly launched items. However, it’s important to note that while these stores can fuel positive brand experiences, their impact on consumer behavior depends on the strength of brand equity and attachment cultivated across the entire marketing mix.

Exclusive own brand retail stores provide unique brand-related interactions and products, offering consumers novel experiences that strengthen their loyalty and deepen their relationship with the brand. Ultimately, the effectiveness of these stores in creating loyal consumers lies in their ability to build strong consumer-brand relationships and deliver memorable brand experiences consistently.

Challenges: The advantages of exclusive own brand retail stores in the FMCG sector are widely recognized. However, establishing and operating these stores under a franchise model presents both significant opportunities and challenges. While opening an exclusive own brand retail store may seem straightforward, ensuring its success under a franchise model where each store must reach breakeven and profitability, while expanding without closures or dropouts, is particularly challenging.

The primary reasons for closures and dropouts of exclusive own brand retail stores often stem from the franchisee’s inability to achieve profitability as outlined in the franchise plan and agreements, which are detailed in the Franchise Disclosure Document. This document sets clear expectations regarding financial performance and operational standards that franchisees must meet to sustain their business.

In essence, while the potential benefits of franchising exclusive own brand retail stores are considerable, ensuring consistent profitability across multiple locations while maintaining franchisee satisfaction and operational excellence remains a complex endeavor in the FMCG industry.

Franchise failures often stem from shortcomings on the part of the franchisor in executing their role effectively. These include:

- Franchisee Selection: One of the most common errors is choosing franchisees solely based on their financial capability. While financial stability is crucial, successful franchisees also need a strong work ethic and alignment with the company’s values. Selecting franchisees who embody these traits is essential for long-term success.

- Franchise Disclosure Document (FDD): The FDD outlines what the franchisor offers to prospective franchisees, including intellectual property rights, branding, products, and trade secrets. It forms the legal basis of the franchisor-franchisee relationship, detailing rights and responsibilities for both parties.

- Site Selection and Territory Allocation: Effective site selection and territory allocation are critical. Franchisors should choose locations based on demographic suitability and potential customer base. Territories should be structured to avoid intra-franchisee competition and conflict with other distribution channels like distributors.

- Training and Marketing Support: Ongoing training and support are crucial for franchisee success. This includes product knowledge, operational training, administrative guidance, and effective marketing strategies. Clear communication on who bears the costs associated with training and support should be outlined in the franchisor-franchisee agreement.

- Financial Support until Break-even: Franchisors should provide necessary support until the franchisee achieves break-even and profitability. This may involve financial assistance, operational guidance, and marketing initiatives tailored to the franchisee’s specific needs.

By addressing these key areas effectively, franchisors can mitigate the risks associated with franchise failures and foster sustainable growth for both parties involved in the franchise relationship.